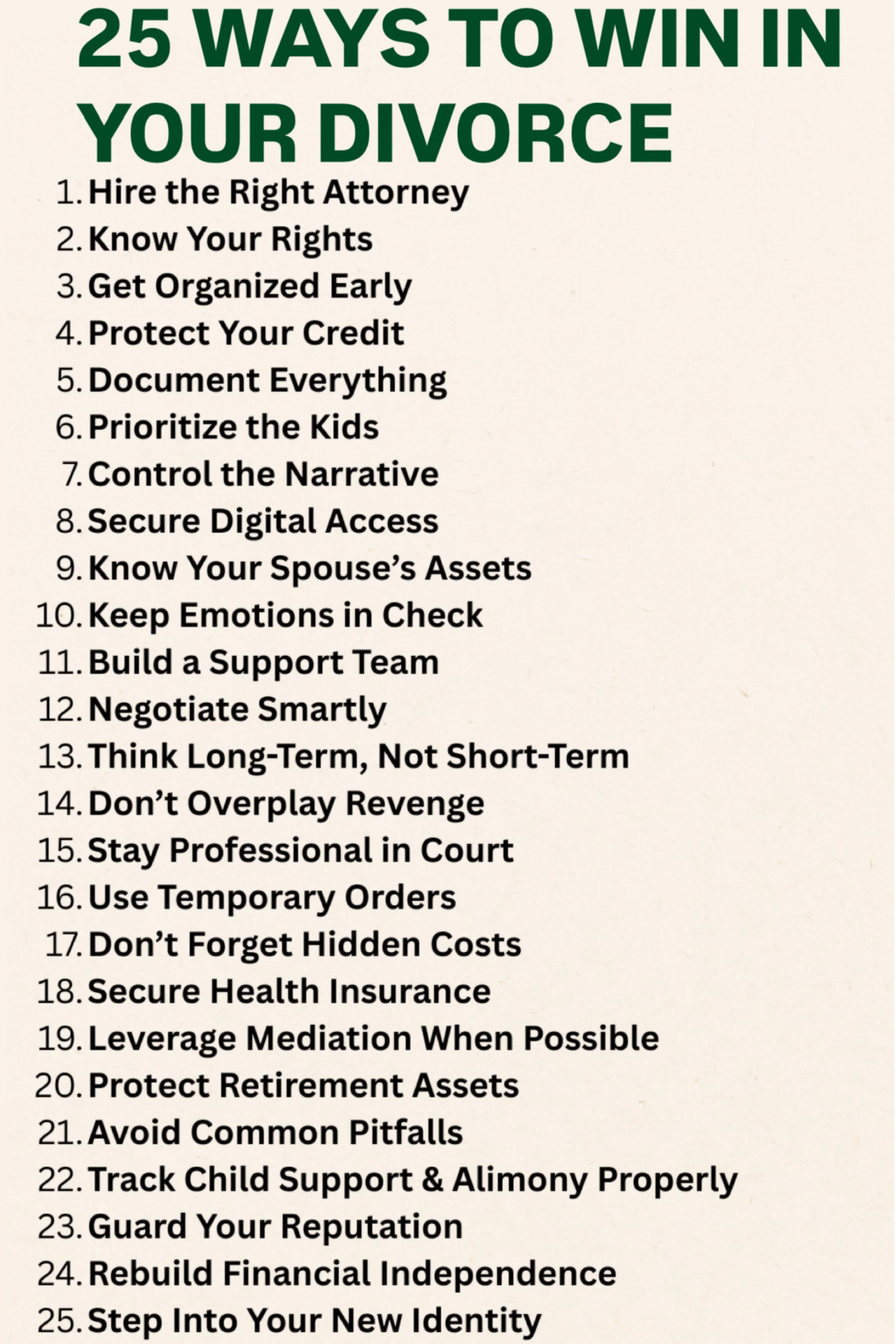

25 Smart Ways Women Can Win in Divorce and Build a Stronger Future

25 Ways to Win in Your Divorce

1) Hire the Right Attorney

Selecting counsel is a leverage decision, not a luxury. Interview at least two or three family-law specialists and ask targeted questions: What’s your strategy for my facts? Where do judges in this county tend to land on custody/support? How do you staff discovery to keep fees reasonable? Request a frank estimate of best case / worst case / most likely outcomes and the cost drivers for each (discovery volume, valuations, custody evaluations, trial prep). Clarify communication norms (response times, who you’ll email day-to-day), billing increments, and when to mediate vs. litigate. Red flags: vague answers, pressure to “just file now,” or promises that sound like guarantees. Match attorney temperament to your spouse: collaborative counsel for a reasonable ex; courtroom closer for a scorched-earth one. Align incentives with phased budgets and explicit settlement targets so everyone pushes toward resolution, not endless motion practice. Remember: the “cheapest” lawyer can become the most expensive if they miss issues that cost you retirement assets, parenting time, or long-term support. Spend smart on expertise, keep meticulous records, and treat your lawyer like a strategic partner you actively manage.

Essentials:

- Women’s divorce law handbook

- Legal pad + high-contrast pens

- Accordion case file organizer

- Portable document scanner

- Budget planner for legal fees

2) Know Your Rights

Knowledge shrinks fear and blunts intimidation. Learn your state’s rules on marital vs. separate property, equitable distribution/community property, child custody standards (“best interests”), support calculators, and how courts treat premarital assets, inheritances, commingling, and reimbursements. Understand discovery (interrogatories, subpoenas), financial affidavits, and disclosure deadlines. If retirement accounts are in play, read the basics of QDROs so you don’t lose tens of thousands to execution mistakes. Build a quick-reference sheet: key statutes, deadlines, and what evidence best proves each issue. Verify everything with reputable sources (state judiciary websites, bar association guides, and your attorney). Knowing your rights helps you evaluate offers, push back on “that’s just how it is,” and spot bad-faith tactics (asset dissipation, pressure to rush signatures, or “forgetting” equity, RSUs, or business goodwill). Educated clients negotiate better, ask sharper questions, and avoid concessions they’ll regret.

Essentials:

- State family-law quick guide

- QDRO basics reference

- Sticky tabs + highlighters

- Three-ring binder (legal size)

- Page protectors for exhibits

3) Get Organized Early

Courts run on paper; organization is advantage. Start a master folder system: Income, Banking, Credit Cards, Loans, Real Estate, Vehicles, Retirement, Investments/Stock Options, Insurance, Business Interests, Taxes (last 5 years), Household/Child Expenses, and Communications. Digitize everything to searchable PDFs; name files consistently (YYYY-MM-DD_Source_Type_Description). Keep backups in a secure cloud plus an external encrypted drive. Create a “Financial Snapshot” spreadsheet listing every account number (redacted for safety), institution, balance, owner, and monthly payment. Track recurring expenses and children’s costs (school, medical, activities) with receipts. The goal: when your attorney asks, you can deliver a clean packet in minutes, not weeks—saving fees and avoiding continuances. Organized parties look credible to judges and mediators, and they make it harder for a spouse to hide money, minimize income, or delay discovery. Set a weekly admin hour to file, reconcile, and update your snapshot so you’re always trial-ready.

Essentials:

- Fireproof/waterproof document bag

- Hardware-encrypted SSD

- Receipt/document scanner

- Color file folders + labels

- Cloud backup gift card/top-up

4) Protect Your Credit

Your credit score is permission to move forward—renting, refinancing, even job screens. Pull tri-bureau reports and dispute errors immediately. Freeze your credit with all bureaus to block new accounts, then methodically separate joint credit lines: close, convert to individual, or set written rules under temporary orders. Put autopay on essential bills to avoid late marks during chaos. If your spouse handles finances, change that now—monitor alerts, enable 2FA, and forward statements to your secure email. Build a realistic post-separation budget so you don’t slide into debt while litigation drags. If a mortgage is joint, track payments religiously; missed payments stain both scores regardless of the decree. Consider a secured card in your name to strengthen independent history. Credit protection isn’t paranoia; it’s prevention—easier than repairing months of damage after the fact.

Essentials:

- Credit report monitoring tools

- Identity theft protection

- Cross-cut paper shredder

- Budget planner + bill tracker

- Locking file box

5) Document Everything

Evidence wins close calls. Keep a contemporaneous log of interactions, missed pickups, payments, and any concerning conduct—dates, times, facts only. Save emails and texts to PDF (export regularly); screenshot crucial threads and store them in your case folders. Photograph valuables and rooms (with date metadata) to establish baseline property conditions. Track parenting involvement: calendars for appointments, school events, activities, and transportation. For expenses, keep itemized receipts and create monthly summaries—courts appreciate organized proof over anecdotes. Stay ethical: follow your state’s rules on privacy and recording; never snoop illegally. The aim isn’t to wage a surveillance war; it’s to create a reliable record that supports reasonable requests for custody schedules, reimbursements, or support. When negotiations stall, a clear, neutral evidence packet often breaks the impasse.

Essentials:

6) Prioritize the Kids

Courts are laser-focused on the “best interests of the child.” If you want leverage, demonstrate you consistently prioritize stability, health, and education. Avoid bad-mouthing your spouse to the kids—judges hate parental alienation. Instead, document your involvement: parent–teacher conferences, medical visits, extracurriculars. Maintain consistent routines even in chaos—bedtimes, homework habits, and safe environments. Show flexibility when it benefits the children (e.g., swapping weekends for a school event). Keep a calendar of parenting duties and preserve communications about children’s needs. When decisions are reviewed, you’ll look like the parent fostering stability. Winning here isn’t about “taking kids away,” it’s about showing you’re the anchor parent. That credibility carries immense weight in both custody negotiations and child-support rulings.

Essentials:

- Co-parenting communication app guides

- Child activity planner

- Document storage for school/medical records

- Family calendar board

- Parenting log notebooks

7) Control the Narrative

Your tone, communication, and reputation create a narrative judges and mediators absorb. Write every email and text as though it will be read in court—professional, concise, factual. Avoid profanity, threats, or emotional spirals. Use “I” statements that frame concerns neutrally: “I need clarity on the pickup time” instead of “You never show up.” Social media should be scrubbed—set accounts to private, stop posting anything that can be misinterpreted. Judges and evaluators notice stability, restraint, and constructive communication. If your spouse tries to bait you, don’t respond in kind. Silence or short factual replies preserve your credibility. In divorce, controlling the narrative doesn’t mean spinning lies—it means presenting yourself consistently as the reasonable adult in the room.

Essentials:

- Communication etiquette books

- Co-parenting email templates

- Social media audit guide

- Professional writing reference

- Daily stress-relief journal

8) Secure Digital Access

Digital security is an overlooked battlefield. Immediately change passwords on all personal accounts—email, banking, cloud storage, social media. Use a password manager to create unique, strong combinations. Enable two-factor authentication and update recovery methods so your spouse can’t reset access through shared phones or emails. Audit devices for spyware or unauthorized logins. Back up vital files and correspondence to secure drives or encrypted cloud services. If you shared accounts, open new ones for finances, subscriptions, or utilities. Digital footprints often become discovery goldmines—control yours before your spouse does. Protecting access ensures you won’t be blindsided by drained accounts, sabotaged communications, or disappearing documents.

Essentials:

- Password manager subscription

- Two-factor authentication keys

- Encrypted USB drive

- VPN subscription

- Identity monitoring service

9) Know Your Spouse’s Assets

Hidden assets and underreported income are common. Look for sudden transfers, new “loans,” overpayments, or suspicious business expenses. If your spouse is self-employed, review business records carefully—unreported cash, deferred income, or personal expenses written off as business costs are classic tactics. Watch for property deeds, vehicles, crypto wallets, or investment accounts not previously disclosed. Hire a forensic accountant if stakes are high. Even small hidden accounts add up when multiplied across years of support and property division. Knowledge gives you negotiating leverage: spouses often fold once they know you’ve uncovered discrepancies. Don’t assume transparency—verify.

Essentials:

- Forensic accounting basics book

- Financial statement templates

- Calculator + spreadsheet guide

- Bank/asset tracking ledger

- Intro to crypto wallets guide

10) Keep Emotions in Check

Divorce is engineered to test emotional control. Outbursts in court, hostile texts, or impulsive decisions can cost custody and financial advantages. Practice emotional regulation like it’s case prep. Use therapy, journaling, exercise, or mindfulness to release pressure outside of legal settings. Keep courtroom demeanor calm and businesslike—dress neatly, speak respectfully, avoid interruptions. Negotiations stall when one side explodes, but progress happens when you stay composed under stress. Judges reward parties who demonstrate emotional maturity, especially around children. Make it your goal to be the most stable person in every room—it undermines your spouse’s accusations and strengthens your credibility.

Essentials:

11) Build a Support Team

Divorce is too heavy to shoulder alone. Build a circle of trusted allies—family, friends, a therapist, a financial advisor, and your lawyer. Each plays a role: emotional stability, practical help, and professional expertise. A therapist helps you process grief without dumping it into legal communications. Financial advisors can forecast long-term impacts of settlement options. Friends provide encouragement and help with childcare or logistics. The right support team prevents isolation, protects mental health, and ensures you make rational, not reactionary, decisions. Lean on people who build you up, not those who fuel conflict. Your support system is your shield.

Essentials:

- Divorce support books

- Therapy workbook

- Financial planning guide

- Motivational journal

- Self-care kit items

12) Negotiate Smartly

Divorce is negotiation, not war. Smart negotiators know when to hold firm and when to trade. Think of assets like puzzle pieces—maybe you care less about a vacation home but deeply about retirement stability. Offering concessions on low-priority items can secure what matters most. Always weigh the long-term value of an asset, not just immediate satisfaction. Never accept first offers without review. Work with your attorney to develop negotiation ranges and fallback positions. Keeping a calm, data-driven approach prevents wasted time in court and often leads to better overall settlements.

Essentials:

- Negotiation strategy books

- Legal negotiation workbook

- Notebook for settlement tracking

- Calculator for asset splits

- Stress ball set

13) Think Long-Term, Not Short-Term

Short-term wins often become long-term losses. Keeping a house you can’t afford may feel victorious, but it can cripple future finances. Evaluate every decision against future realities: retirement savings, children’s college, and sustainable living costs. Focus on assets that appreciate in value (retirement accounts, pensions) over depreciating ones (vehicles, luxury items). Consult a financial advisor to project 5-, 10-, and 20-year outcomes. Long-term vision transforms your divorce from a battle into a stepping-stone toward security and independence.

Essentials:

- Financial forecasting workbooks

- Retirement planning guide

- College savings planner

- Debt payoff tracker

- Long-term budgeting spreadsheets

14) Don’t Overplay Revenge

It’s tempting to use divorce to punish, but revenge is expensive and often backfires. Prolonged litigation drains money and emotional reserves. Judges dislike parties who appear vindictive—it undermines credibility. Focus on fair outcomes that support your future, not on inflicting pain. Channel frustration into preparation: organization, documentation, and negotiation. Remember, revenge may feel sweet in the moment but leaves bitter consequences. Winning is building stability, not feeding conflict.

Essentials:

- Emotional resilience guides

- Anger management workbook

- Meditation tools

- Positive psychology books

- Stress relief tea set

15) Stay Professional in Court

Court is theater, and judges notice everything. Dress neatly, avoid flashy or provocative outfits, and appear respectful. Address the judge formally, never interrupt, and let your lawyer lead. Bring organized materials in case asked. Even body language speaks—eye rolls or sighs can damage credibility. Staying professional signals maturity and responsibility, especially in custody cases. Think of yourself as your own brand ambassador—calm, prepared, and respectful.

Essentials:

16) Use Temporary Orders

Temporary orders establish structure while the divorce proceeds. These cover custody, visitation, support, and who pays which bills. File early to create precedent—judges often extend temporary arrangements into permanent ones. If you’re the primary caregiver, request temporary custody quickly to formalize your role. Secure financial orders so you’re not left covering everything alone. Temporary orders protect against chaos and strengthen your position in final negotiations. Treat them seriously—they set the tone for the entire case.

Essentials:

- Family law temporary orders guide

- Legal form templates

- Court preparation notebook

- Organizational binder set

- Reminder calendar

17) Don’t Forget Hidden Costs

Settlements often ignore practical expenses: property taxes, maintenance, insurance, or school fees. That “dream house” could bankrupt you if upkeep exceeds income. Make a line-item budget for every asset you might keep. Include utilities, repairs, insurance premiums, and tax implications. Factor in healthcare, childcare, and commuting costs. Presenting clear math in negotiations shows foresight and helps secure fairer terms. Smart awareness of hidden costs prevents financial traps disguised as “wins.”

Essentials:

- Household budget planner

- Property tax guide

- Home maintenance logbook

- Insurance planning workbook

- Expense tracking sheets

18) Secure Health Insurance

Post-divorce, many women lose coverage if it came from their spouse’s employer. Plan early: investigate COBRA, ACA marketplace options, or employer benefits if available. Factor premiums and deductibles into settlement negotiations—health insurance is as vital as income. Don’t let coverage lapse during proceedings; gaps can cause huge out-of-pocket expenses. Secure health insurance before finalizing the divorce so your future isn’t jeopardized by unexpected medical costs.

Essentials:

- Health insurance guidebook

- Medical expense log

- Prescription organizer

- Health savings account tracker

- Wellness planner journal

19) Leverage Mediation When Possible

Mediation is often faster, cheaper, and less hostile than litigation. A neutral mediator facilitates agreements, saving thousands in legal fees. Mediation also gives you more control over outcomes—courts impose rulings, while mediation builds compromise. Prepare by knowing your bottom line and areas you can flex. Bring organized financials and custody proposals. Even if mediation doesn’t resolve everything, it often narrows disputes, reducing court time. Judges respect parties who attempt good-faith mediation.

Essentials:

- Mediation preparation guide

- Conflict resolution workbooks

- Notepad for negotiation notes

- Calm focus tea

- Organizer for mediation documents

20) Protect Retirement Assets

Retirement accounts are often the largest marital assets, yet many women overlook them in favor of tangible property. Pensions, 401(k)s, and IRAs can be divided with a QDRO (Qualified Domestic Relations Order). Ensure your lawyer includes proper language so you receive your rightful share without tax penalties. Evaluate long-term growth—retirement savings often outpace property appreciation. Secure your financial independence by prioritizing retirement assets in settlement talks, even over the family home.

Essentials:

21) Avoid Common Pitfalls

Many divorces unravel because of avoidable mistakes: moving out too soon, overspending, or agreeing to terms without full review. Don’t sign anything under pressure—always let your lawyer examine documents. Avoid new relationships splashed on social media, as they can complicate custody. Don’t stop paying bills without a court order, and never hide assets; judges penalize dishonesty. Keep calm and strategic, not reactive. Awareness of common traps keeps you from sabotaging your own case.

Essentials:

- Divorce pitfalls guide

- Financial discipline journal

- Legal checklist binder

- Neutral wardrobe basics

- Confidential document safe

22) Track Child Support & Alimony Properly

Support payments can become messy. Always use official state systems or escrow services to document payments. Avoid cash—without receipts, disputes are inevitable. Keep meticulous records of every payment received or missed. If adjustments are needed due to income changes, file promptly. Courts respect accurate logs. Don’t rely on informal agreements; formal orders protect you and your children.

Essentials:

- Child support tracking logbook

- Payment receipt organizer

- Spreadsheet templates

- Calendar bill reminder

- Family finance planner

23) Guard Your Reputation

Divorce can invite gossip and scrutiny. Protect your reputation by acting with dignity in public and online. Employers, neighbors, and even judges may hear stories—your conduct should counter them. Avoid venting on social media; use private support systems instead. Highlight your professionalism, community involvement, and parenting dedication. Reputation is leverage—it can influence custody decisions and even financial negotiations.

Essentials:

- Reputation management books

- Social media clean-up guide

- Professional portfolio binder

- Community volunteering guide

- Confidence coaching workbook

24) Rebuild Financial Independence

Divorce resets your financial identity. Start with a budget based solely on your income and obligations. Build emergency savings, pay down debts, and learn investing basics. Open accounts in your own name—checking, credit, retirement. Financial independence is both practical and psychological—it rebuilds confidence. Work with a financial planner if needed. Independence is the true long-term “win” after divorce.

Essentials:

- Budgeting planner for women

- Emergency fund tracker

- Investing 101 books

- Debt payoff log

- Financial independence guides

25) Step Into Your New Identity

Divorce is an ending and a beginning. Use this transition to rediscover yourself—your passions, goals, and strengths. Create a vision for your next chapter: career, personal growth, and relationships. Surround yourself with people who inspire, not drain. Try new activities, travel, or hobbies that remind you of your independence. Stepping into your new identity is the final victory—proving that divorce didn’t just free you from the past, it propelled you into a stronger future.

Essentials:

- Self-discovery journals

- Vision board kits

- Travel inspiration books

- Career coaching guides

- Empowerment jewelry

Essentials Roundup

To support your journey, here’s a curated roundup of useful essentials every woman navigating divorce should consider:

- Comprehensive divorce guidebooks

- Financial planning workbooks

- Document organizers and scanners

- Therapy and mindfulness journals

- Professional attire for court

- Budget planners and debt trackers

- Parenting time calendars

- Identity theft and credit protection tools

- Self-care and empowerment kits

- Vision and goal-setting tools